Official Statement on Kaiaswap

We aim to summarize the recent issues that have arisen within the community regarding the Kaiaswap team and to clarify the official…

Kaia Foundation’s mission and obligation is to work for the benefit of all members of the Kaia ecosystem. We respect builders and users alike, and we want to build an ecosystem where everyone can grow together. In this article, we aim to summarize the recent issues that have arisen within the community regarding the Kaiaswap team and to clarify the official position of the Kaia Foundation.

1. D2I Selection Process and Results

In the first half of 2024, three Dex projects were selected for support in the D2I program through a fair process using external reviewers.(Grant Committee Members)

Grant Committee Members

• Alwin Peng, CTO of Vertex

• Colin, VP of Strategy at Klaytn Foundation

• Doo Wan Nam, COO of Stablelabs

• Earl, Senior Consultant at Despread

• John, Research Analyst at Presto Labs

• Mike, Head of Research at Undefined Labs

• Moonsoo, Co-founder of Lano Technology

• Ryan, CTO of Swapscanner

Based on the results of the grant committee member’s selection, the Foundation signed support contracts with the Kaiaswap team in the form of a) Dev Grant, b) Liquidity Incentive Grant, and c) Liquidity Provision Grant.

a) Dev Grant: to assist and support the development and launching of the Project;

b) Liquidity Provision Grant: to support the minimum liquidity for the launching of the Project

c) Liquidity Incentive Grant: to increase TVL, reduce the burn rate of DApps, and support user acquisition costs (UAC); or

d) any other purposes mutually agreed upon by the Parties in writing.

The following is a breakdown of the amount and status of the Kaiaswap team. Usage history for the grants is shown below.

a,b) Dev Grant & Liquidity Incentive Grant

- Total number of executions: 2,226,274 KAIA

- Execution date: May 16, 2024 (Transaction)

- Execution Amount: KAIA worth $375,000

a) Dev Grant: $25,000 of the $50,000 has been paid out (approximately 150,000 Kaia)

b) Liquidity Incentive: $350,000 worth of KAIA. 25% of the $1,400,000 Liquidity Incentive Grant. Remaining: 938,583 KAIA

*iZUMi D2I Wallet address: 0x4d9eb5be0ae58d5a6c32a816702d89af8ae7a096 (address link)

c) Liquidity Provision Grant

- The Foundation and the iZUMi team have created a KLAY/USDC.e (Stargate) liquidity pool, with the Foundation contributing $150k (KAIA) and iZUMi contributing $150k (USDC).

- Analytics could be found here.

2. Kaiaswap’s recent issues

As for the delay in the Foundation’s official response, we were made aware of the issue by the community, and it took quite a while for the Foundation to understand the issues raised by the Kaiaswap team and the community, and to balance the differences between the two sides’ perceptions and how they communicated about the issue.

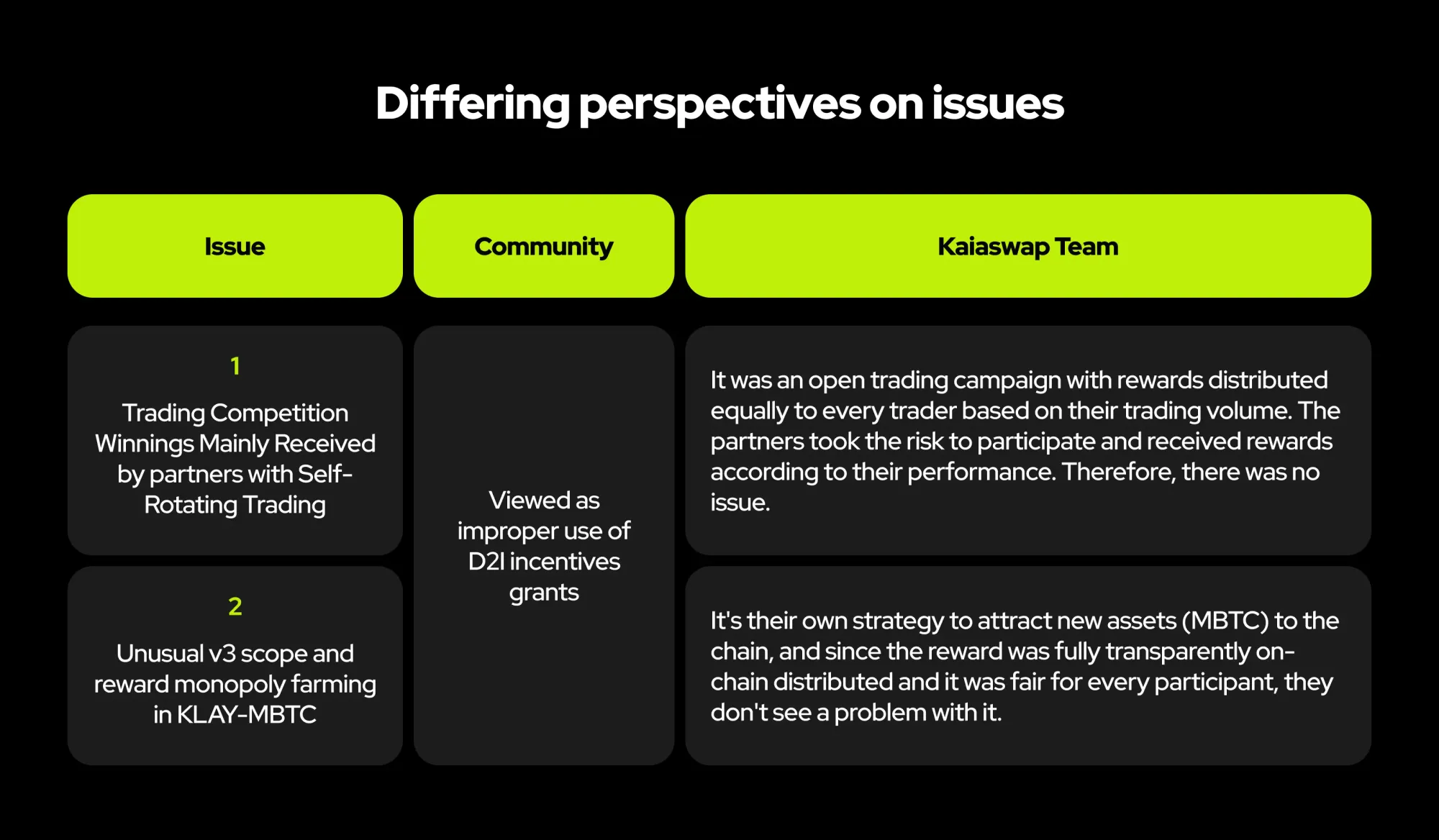

There are two main issues raised by the community:

- Trading Competition Winnings Mainly Received by partners with Self-Rotating Trading

- Unusual v3 scope and reward monopoly farming in KLAY-MBTC

As the operator of the D2I program and a contracting party, the foundation has reviewed potential issues in the actions of Kaiaswap, including the aforementioned concerns.

- Are there any violations of the D2I Agreement?

a) Issues 1 and 2 do not work against the goal of increasing trading volume and raising TVL.

b) The wording of the Grant Agreement, “ If the Grant Tokens are used in an abusive or improper manner” could be argued against.

- Lending to partners to participate in trading competitions could be considered an improper use of the Grant.

The use of NFTs to move tokens or volume to exchanges may also be considered methodologically inappropriate. - Did the Kaiaswap team engage in behavior that directly benefited them?

a) KaiaSwap team has not taken liquidity incentives and trading rewards beyond public rules and campaigns, according to their statement and provided proof of blockchain transactions.

b) Even though it was an open competition, it is problematic that the professional trading firms and liquidity providers received more prize money than retail users from the competition. The promotion was not designed in a way that would be accepted by a large number of retail users. - Did the action follow the direction of the D2I? Did it follow the D2I guidelines well?

a) Allowing professional trades and liquidity providers to profit from self-rotating trades does not seem to be beneficial to Kaia’s DeFi ecosystem, even if it is to increase trading volume. As proof of this, the volume of trading on Kaiaswap decreased significantly after the event. Therefore, it is difficult to conclude that the trading competition actually produced lasting results.

b) Incentivizing unused liquidity is a way of farming incentives while lowering risk, i.e., bringing in MBTC and increasing TVL, which is not easily acceptable when compared to other V3-style DEXes. It’s hard to see this as a way to help Kaia’s DeFi in the long run.

c) The intention of the grant is to revitalize the ecosystem. KaiaSwap’s campaigns seem to be more beneficial to a few, where changes need to be made. - Was it nonetheless a helpful behavior for Kaia?

a) While it may be beneficial in terms of quantitative data such as TVL and transaction volume, it is difficult to evaluate the reasonableness of continuing the promotion through D2I resources, which are publicly funded.

b) Especially, some questions proposed by some community members were not answered accurately to end the suspicion. This is a limitation on the continued use of ecosystem resources.

3. The Foundation’s stance and what’s next

In accordance with the above recognition, the Foundation has made the following decisions regarding Kaiaswap and will be amending the contract.

- For the Liquidity Incentive Grant, the remaining amount is freezed before any new campaigns should be carried on. Liquidity Mining shall be ended at the date of this statement.

- Liquidity Provision Grant shall be redeemed. However, the optimal timing will be discussed again considering impermanent loss.

- This is the end of support for D2I, but we will continue to work with the Kaiaswap team.

Termination of D2I contracts

- The Kaia Foundation will terminate the current D2I grant agreement and discontinue utilizing the D2I grant for Kaiaswap.

- The Kaiaswap team will return unused Liquidity Incentives and liquidity provision grant to Kaia’s treasury upon the termination of the D2I grant agreement.

- The Kaiaswap team and the Kaia Foundation will discuss when we can terminate the D2I grant agreement and any follow-up items related to the termination.

- Since there could be impermanent loss (IL) if we withdraw liquidity from Kaiaswap, the Kaiaswap team and the Kaia Foundation will discuss further about whether the liquidity must be withdrawn and if so when it is the best time to withdraw the liquidity.

Future contribution plans agreed upon with the Kaiaswap team

Regardless of the D2I grant, the Kaiaswap team will continue to build Kaiaswap on Kaia and contribute to the growth of the Kaia ecosystem.

- Kaiaswap will buy back more KAIA (KLAY) tokens using Kaiaswap’s revenue until the end of this year.

- If Kaiaswap issues its token in the future, the Kaiaswap team will allocate more tokens for the community to increase the community’s engagement.

- The Kaiaswap team will continue building on Kaia with new narratives, including mini Dapp initiatives on both Kaia and LINE.

The Foundation believes that, given the operating agreement, there was insufficient basis to conclude that the Kaiswap team’s campaign design was problematic while it seemed not to be beneficial to the greatest extent for Kaia communities. We do recognize that more specific operating agreement clauses are needed for future grants to the ecosystem. We will improve this further.

And soon we’ll be publishing a report with a retrospective on the D2I program so far and the direction it’s heading in the future.