From Chaos to Opportunity

A Technical Look at Kaia’s MEV Slot Auction

The MEV Problem We Can No Longer Ignore

At 10:47 PM on August 4, 2025, someone lost $900,000 in a single swap on Kaia. They traded 500,000 oXRP (worth ~$1.5M) for 4.4M KAIA (worth ~$630K). The price impact was brutal — oXRP crashed below $1 on the DEX. It took 13 minutes for arbitrageurs to fix the price. Searchers call it ‘legendary money printing.’

It happened again just months earlier. Earlier in 2024, a swap of 948,221 KAIA triggered over 10,000 competing arbitrage transactions within seconds, causing network latency to spike up to 2 minutes and gas fees to increase 30x. The lesson was clear: MEV isn’t a bug you can fix. It’s a feature of how blockchain works and needs better management.

Why MEV is Inevitable

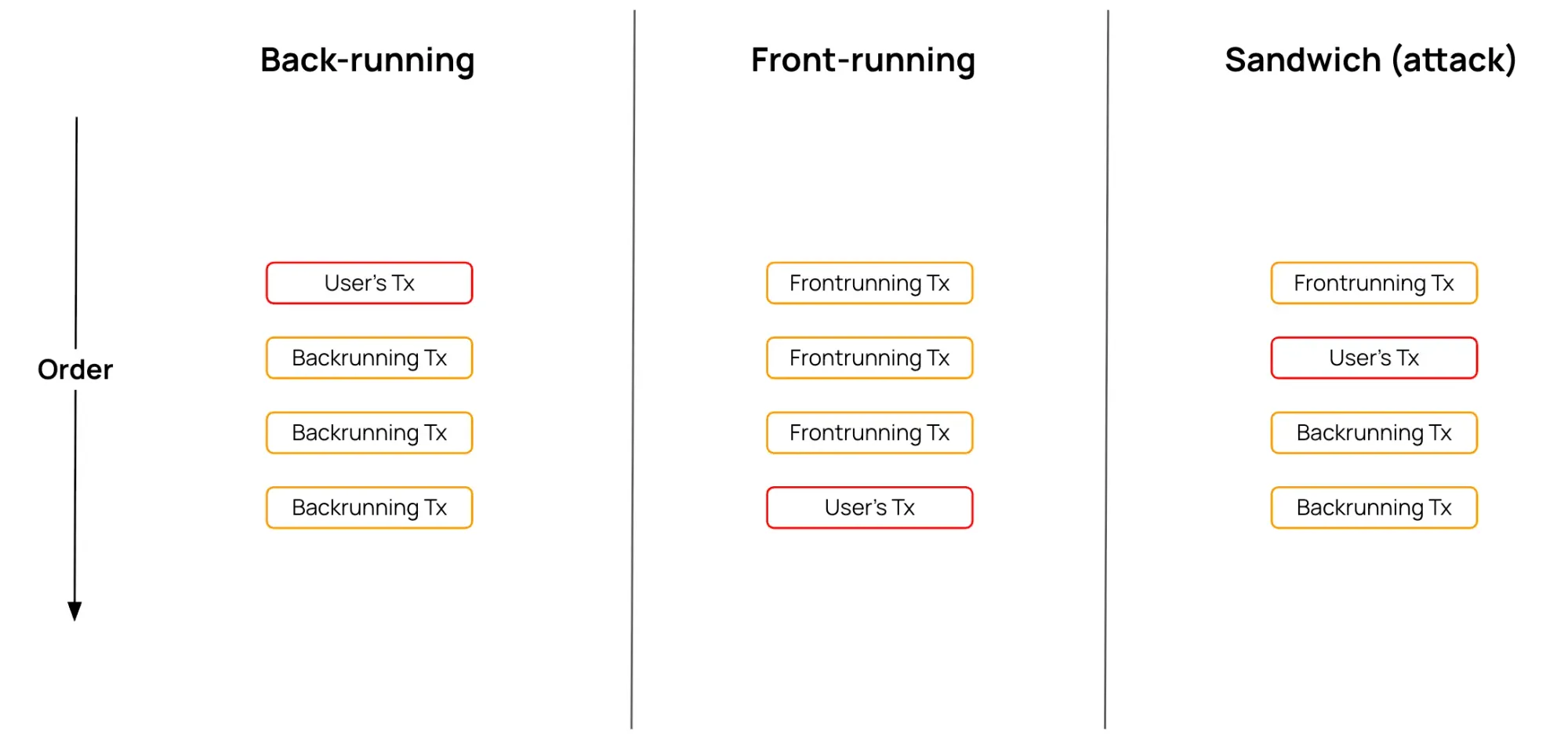

MEV arises from the “batching” nature of blockchain transaction processing. Every block represents an opportunity for reordering, inclusion, or exclusion of transactions. This creates three primary MEV strategies:

- Arbitrage: Profiting from price differences between DEXs

- Front-running: Inserting transactions before user trades

- Back-running: Inserting transactions after user trades

Traditional approaches treat MEV as a problem to solve. But attempting to eliminate MEV in public blockchains is futile. Kaia v2.1.0 transforms MEV from a destructive force into a managed market that benefits the entire ecosystem.

The Current MEV Landscape: A Race to the Bottom

The unmanaged MEV environment creates three critical problems. First, searchers flood the network with competing transactions, degrading performance for everyone. Well-resourced entities monopolize MEV opportunities through superior infrastructure. And there’s no mechanism to prevent validators from colluding with specific searchers.

The consequences hit three areas: Users suffer from unpredictable gas fees and delayed transactions. The network wastes resources processing thousands of failed arbitrage attempts. And the value extracted from the ecosystem concentrates in the hands of a few sophisticated actors.

Kaia’s Solution: Slot-Based Backrun Auctions

Kaia v2.1.0 introduces a new approach: slot-based backrun auctions. Instead of racing blindly for block space, searchers participate in transparent, sealed-bid auctions for guaranteed execution slots immediately following profitable transactions.

Three design choices make this work:

1. Fine-Grained Auction Scope

Unlike Ethereum’s MEV-Boost, which auctions entire block construction rights to sophisticated block builders, Kaia’s approach targets only specific backrun opportunities. This fine-grained design means searchers bid for execution slots after individual transactions rather than controlling entire block ordering. The key advantage is that proposers retain full block construction authority while searchers access MEV opportunities through a transparent auction — no separate proposer agreements, no bundled transaction reordering, no centralization of block production.

2. Network Efficiency

By replacing the spam-driven race with organized auctions, the system eliminates most unnecessary network load. The legendary millions of + transaction flood becomes a streamlined auction process.

3. Fair Competition

Every searcher — from individual developers to well-funded operations — participates under identical rules. The highest bidder wins, period. No special relationships, no infrastructure advantages.

How the Auction System Works

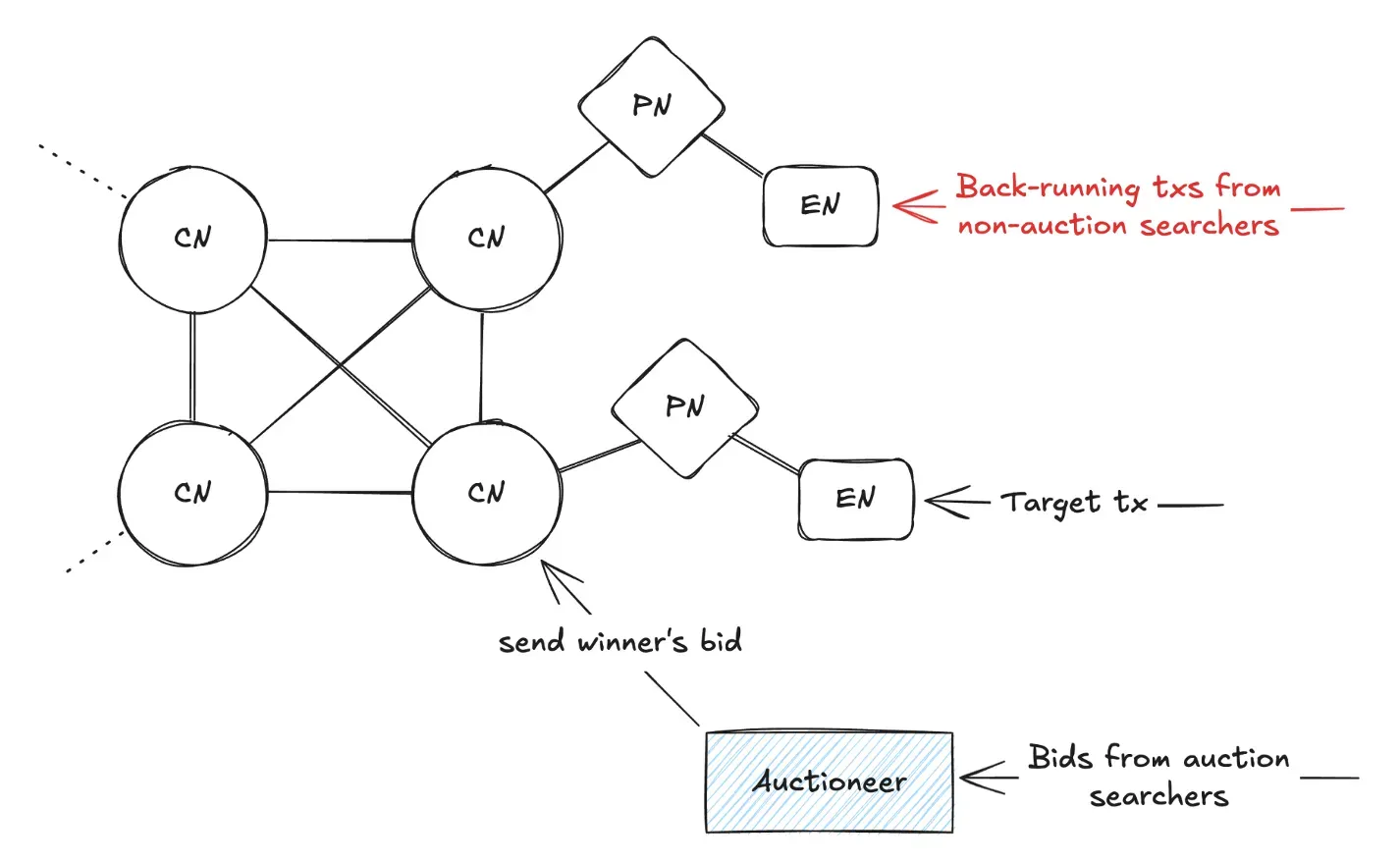

Kaia’s auction system integrates without requiring a protocol hardfork. Consensus nodes running v2.1.0 implement auction processing through new RPC namespaces (auction_submitBid), while the core Istanbul BFT consensus algorithm remains unchanged.

The Auctioneer

An independent, stateless server processes sealed-bid auctions and monitors for fraud. The stateless architecture keeps operating costs low and supports potential decentralization by lowering operational barriers. Currently operated by Kaia Foundation without economic incentives, the Auctioneer functions as a neutral coordinator to ensure fair auction outcomes and fraud detection.

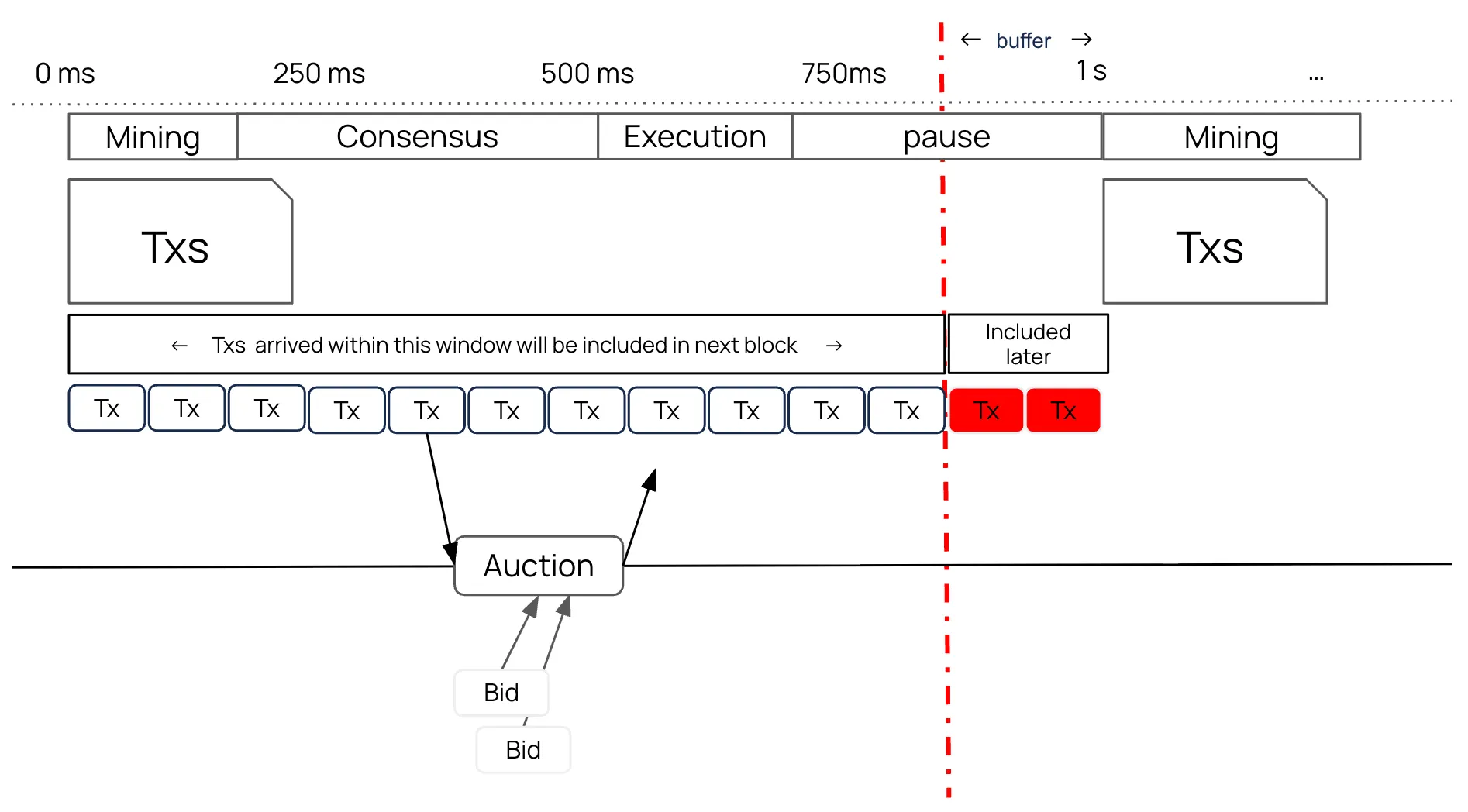

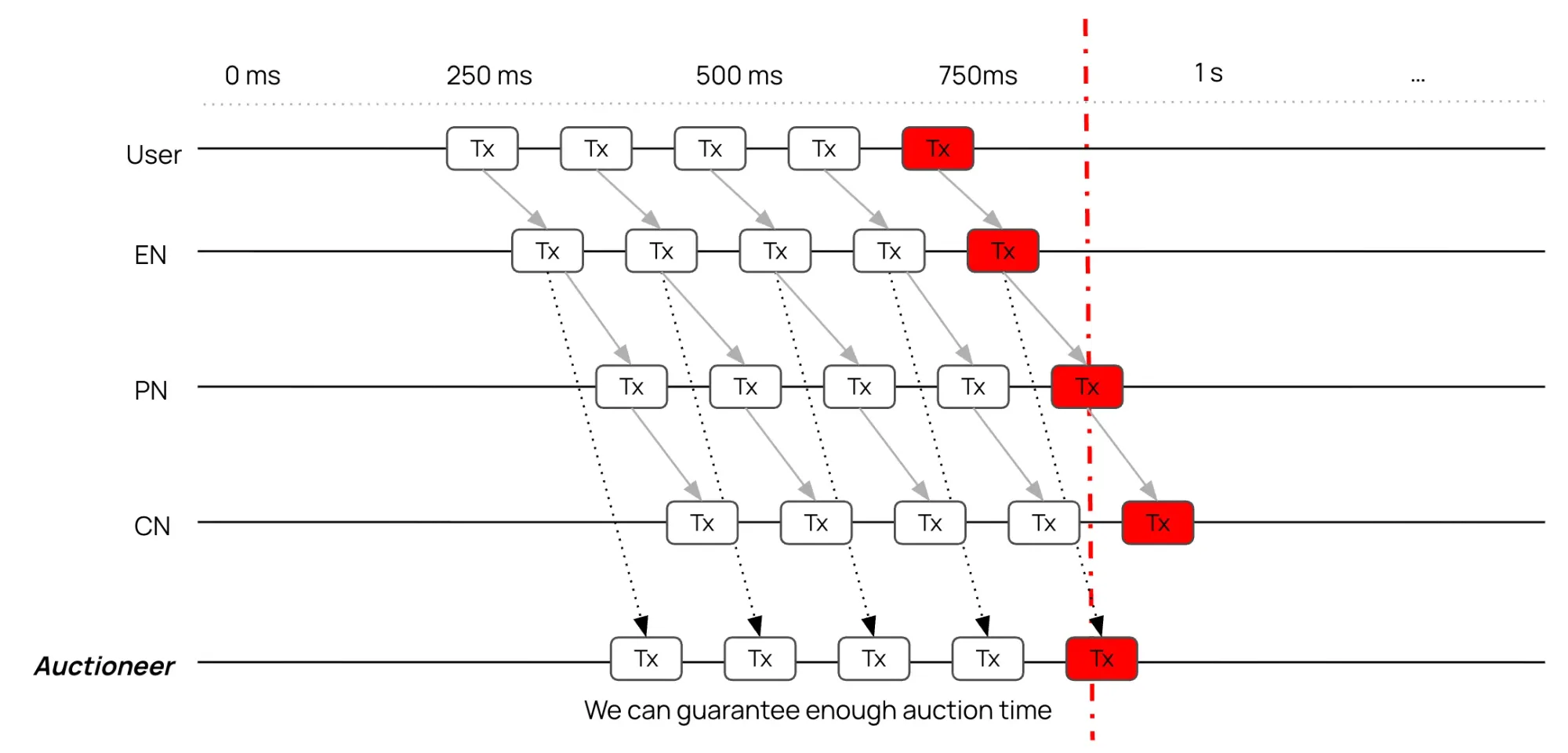

Early Deadline Mechanism

The early deadline (ED) is a guard inside the current block cycle (block n) that ensures the auction result reaches the next proposer in time to be included in block n+1. This timing boundary creates different inclusion rules for auction bids versus ordinary transactions.

- Inclusion rules

– Auction: The winning backrun bundle is inserted by the next proposer in block n+1.

– Ordinary tx:

1. If t ≤ ED(n) → included in block n+1 (seen by the next proposer in time)

2. If t > ED(n) → included in block n+2

Ordinary transactions arriving after ED(n) face a timing penalty and are deferred to block n+2, while winning auction bids can arrive after ED(n) but must reach consensus nodes before mining begins.

Without ED, auctions couldn’t finish in time. Say a large swap arrives after ED(n) that makes many backrun opportunities. Without ED, the next block might be proposed before the auction result reaches the next proposer. ED guarantees that only transactions with enough time to finalize an auction are considered for n+1. The ED is adaptive and configurable (currently positioned a brief interval before mining begins) to sustain performance and broaden search participation. The structure creates a timing advantage for auction bids: ordinary transactions face strict ED deadlines, while winning bids receive extended processing windows up until mining starts.

Smart Contract Layer

Inspired by EIP-4337’s account abstraction, the system uses two key contracts to manage validation and execution through a deposit-based model:

- AuctionEntryPoint: Validates bids, executes backrun transactions, and handles gas refunds

- AuctionDepositVault: Manages searcher deposits, withdrawals¹, and bid payments.

Real-Time Transparency

All auction results — including winning bids and extracted MEV — are publicly accessible through Kaia’s MEV Explorer. This real-time visibility makes everything transparent in the auction process and allows anyone to verify that execution slots are awarded fairly to the highest bidders.

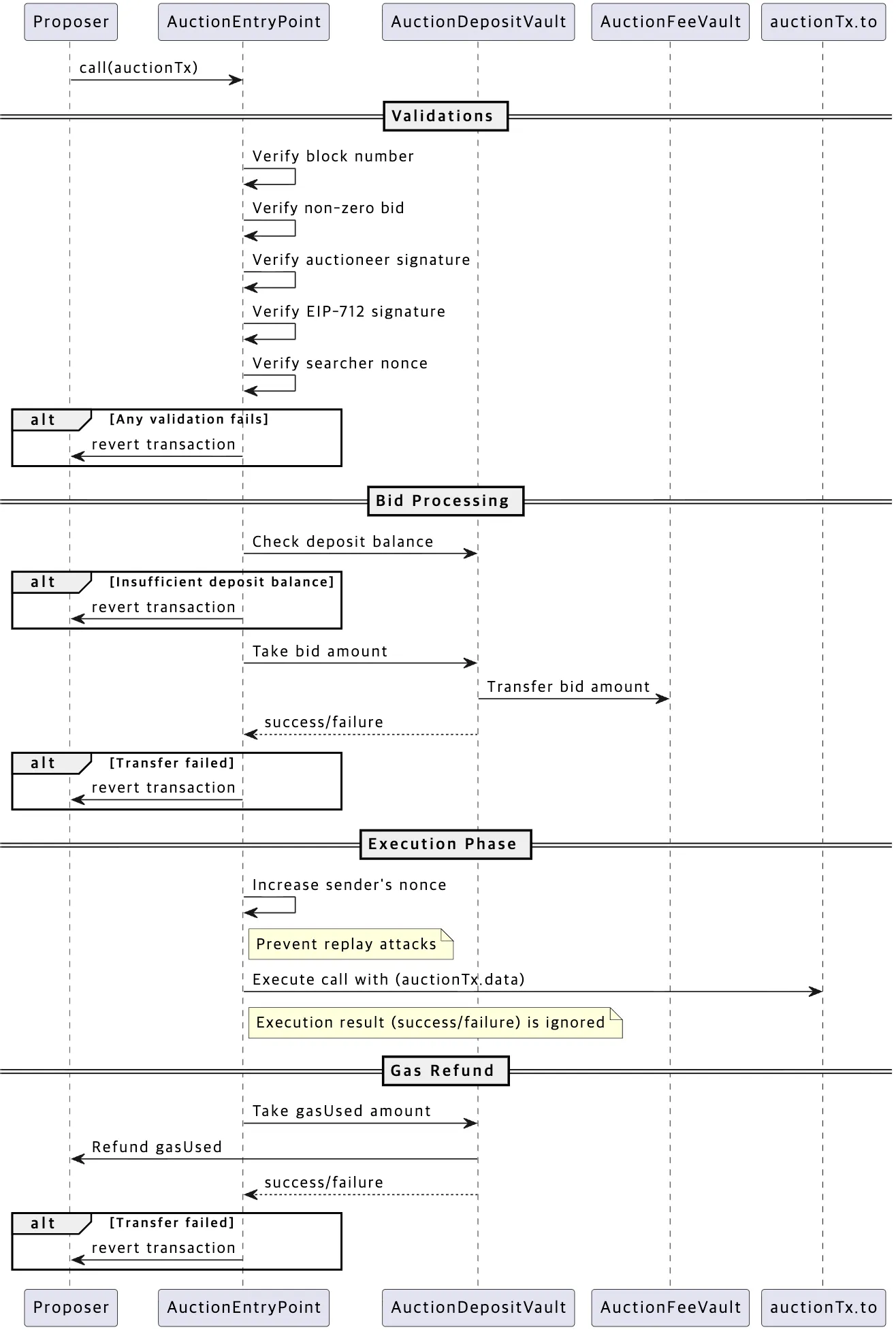

Execution Flow at Consensus Nodes

The diagram shows the complete lifecycle of an auction transaction at the consensus node (CN):

- Validation: Verifies block number, bid amount, auctioneer signature, EIP-712 searcher signature, and nonce uniqueness

- Bid Processing: Checks deposit balance, transfers bid amount to AuctionFeeVault

- Execution: Increments nonce (replay protection), executes the backrun call (success/failure ignored)

- Gas Refund: Deducts actual gas consumed from searcher’s deposit and transfers it to the proposer as part of block rewards (negligible amount in practice)

This multi-phase design prevents several attack vectors:

- Malicious reverting bids: Validators execute on behalf of searchers, so intentional reverts don’t affect block validity

- Replay attacks: Nonce incrementation ensures each bid executes only once

- Unauthorized manipulation: Dual signatures (searcher + auctioneer) validate bid authenticity

- Validator non-compliance: CN nodes running v2.1.0 are configured to process auction results as part of the standard node software implementation. Fraud monitoring detects if validators ignore, replace, or manipulate auction results.

Economic Model: Aligning Incentives

The revenue distribution channels MEV value back into the ecosystem:

- Block Proposers (10%): Incentivized to follow auction results and maintain proper slot ordering

- Ecosystem Fund (90%): Supports development, partnerships, and strategic token burns

Take this example:

- Target Transaction: $100K USDT → KAIA swap

- MEV Opportunity: $1,500 arbitrage available

- Winning Bid: $1,000 for the backrun slot

- Distribution: $100 to block proposer, $900 to ecosystem

In the old system, the full $1,500 goes to whichever bot connects fastest to the validator, contributing nothing to network sustainability.

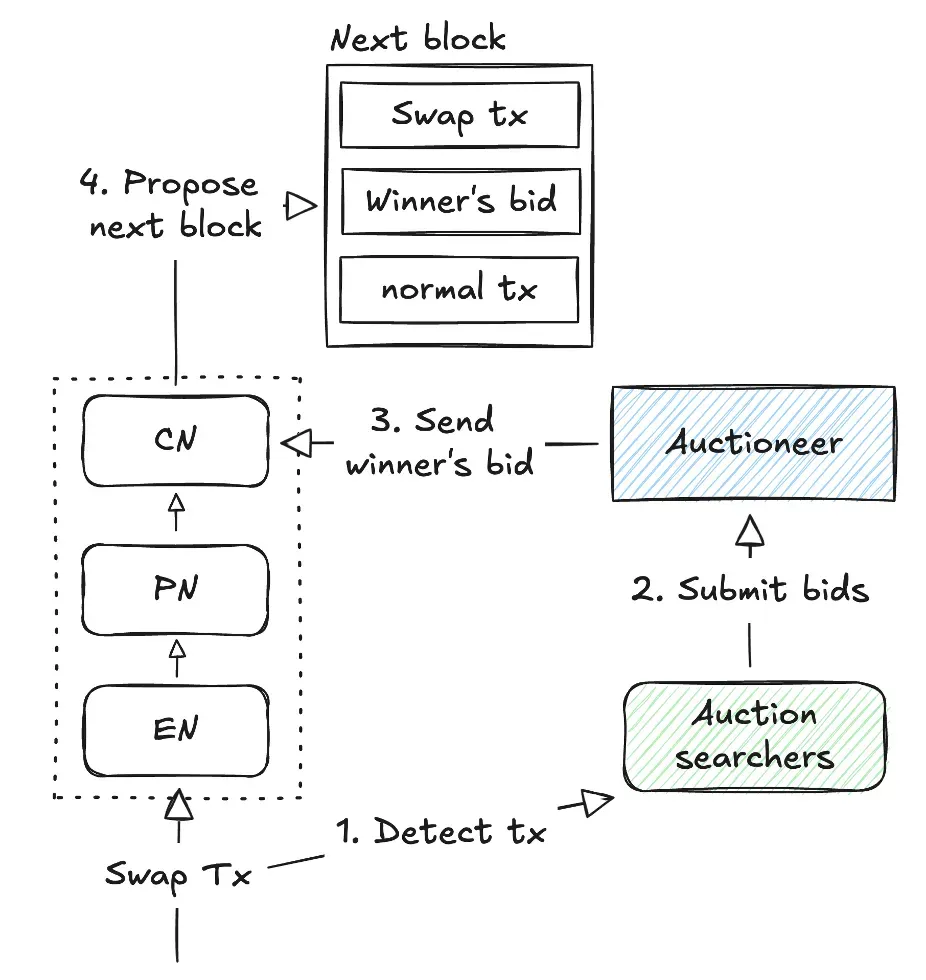

The Complete Auction Flow

- MEV Detection (~100ms): Searchers monitor the network for profitable transactions

- Bid Submission² (~100ms): Sealed bids submitted to the Auctioneer

- Auction Close (~200ms): Highest bid wins automatically

- Block Building: Winning transaction placed in guaranteed slot after target transaction

- Result Recording: All results transparently recorded on-chain

Security and Fairness Mechanisms

Four safeguards protect the system:

Slot-Based Ordering Guarantee Target transactions always precede backrun transactions. Clear slot allocation for each winning bid makes execution predictable.

Transaction Pool Sharing Consensus nodes share pending transaction lists with the Auctioneer, which then distributes this information to all participating searchers.

Early Deadline Enforcement A timing boundary determines inclusion rules for ordinary transactions: those arriving after the early deadline are deferred to later blocks. Auction bids, however, are exempt from this restriction — they can arrive after the deadline but must reach consensus nodes before mining begins. By this, auction bids get a structural advantage over spam-based competition.

Real-Time Monitoring The Auctioneer continuously monitors for MEV auction violations such as validators ignoring bids, replacing bids, or hiding profitable transactions.

What This Changes

Kaia’s MEV auction system tackles an inevitable challenge: you can’t eliminate MEV, so manage it instead. The system:

- Reduces network congestion from competitive MEV extraction

- Channels auction revenue toward ecosystem growth

- Provides equal access to MEV opportunities regardless of infrastructure

The system launched with Kaia v2.1.0 in October 2025 (in Kairos testnet). It allows blockchain efficiency and fair markets to work together.

Getting Started as a Searcher

Want to participate? The complete technical guide, including code examples, API references, and deployment guides, is available in the Kaia Documentation.

Instead of racing bots to steal value, searchers compete in auctions. the network stays fast, and 90% of the revenue goes back into the ecosystem.

¹ Withdrawals use a two-step process: 1) searchers first reserve a withdrawal, then 2) complete it after a 60-second lock period — a security measure preventing instant capital flight during auction manipulation attempts.

² Searchers construct sealed bids containing the target transaction hash, bid amount, execution calldata, and gas limit. Using EIP-712 structured signatures, searchers sign their bid parameters (block number, nonce, bid amount, calldata). The Auctioneer validates these signatures and adds its own signature to winning bids before forwarding them to consensus nodes — preventing both searcher fraud and unauthorized bid manipulation.